It helps in evaluating how well the organization or individual has met their financial targets and objectives. Both terms refer to the process of comparing budgeted amounts to actual results and analyzing the differences or variances between them.īudget vs actuals analysis involves assessing the financial performance by comparing the planned budgeted figures with the actual results that have been realized. Yes, budget vs actuals analysis and budget to actual variance analysis are essentially the same thing. Is budget vs actuals analysis and budget to actual variance analysis the same thing?

#TEMPLATE OF A BUDGET SPREADSHEET MANUAL#

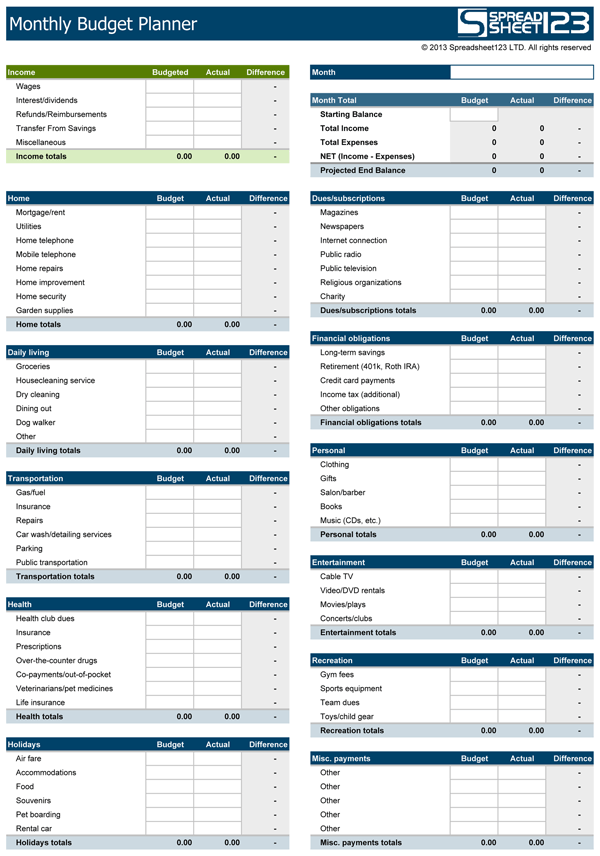

The financial manager will report on these actual versus budget numbers, which usually takes place on a monthly basis using a lot of manual effort. A budget is a report by cost/revenue category showing estimated numbers by month for the next year as agreed upon by management.

The actual amounts may be derived from the accounting system, while the budget amounts are retrieved from the official budget as determined and agreed upon at the end of last year for the current year. Managers are responsible for actual amounts spent versus the corresponding budgeted amounts per category. With this tutorial, however, we hope to show you it doesn’t need to be some cumbersome. You know that reporting budget vs actuals can be both cumbersome and time consuming, given actuals are administered on a detailed level and budget numbers are recorded on a higher level. Gain insights and track financial performance effortlessly.Īs a financial controller, accountant, or CFO, you’re likely familiar with the concept of budget vs actuals.

#TEMPLATE OF A BUDGET SPREADSHEET HOW TO#

In this tutorial, learn how to create a budget vs actuals report in Excel using Power Query.

0 kommentar(er)

0 kommentar(er)